Good morning Real Estate Professionals, I wanted to update you on the near future and why we feel this way. Recent economic data, like Retail Sales has shown consumers are remaining resilient in this higher inflation environment. Is this TRUE or an illusion?

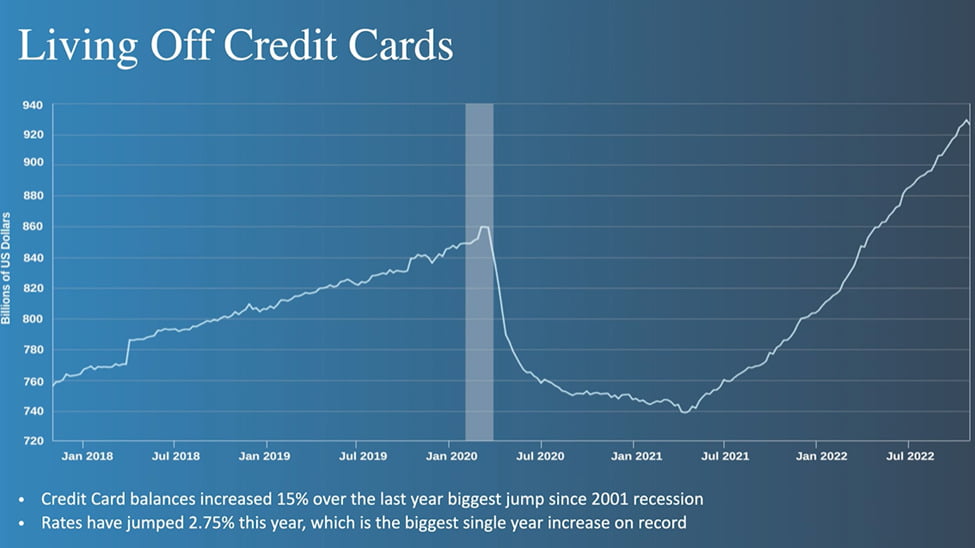

As we see above, people are living off Credit Cards. Credit card debt is up 15% over the last year, the largest jump since 2001 recession. Additionally, servicing that debt has become more difficult, as rates on credit cards have jumped 2.75% due to Fed rate hikes.

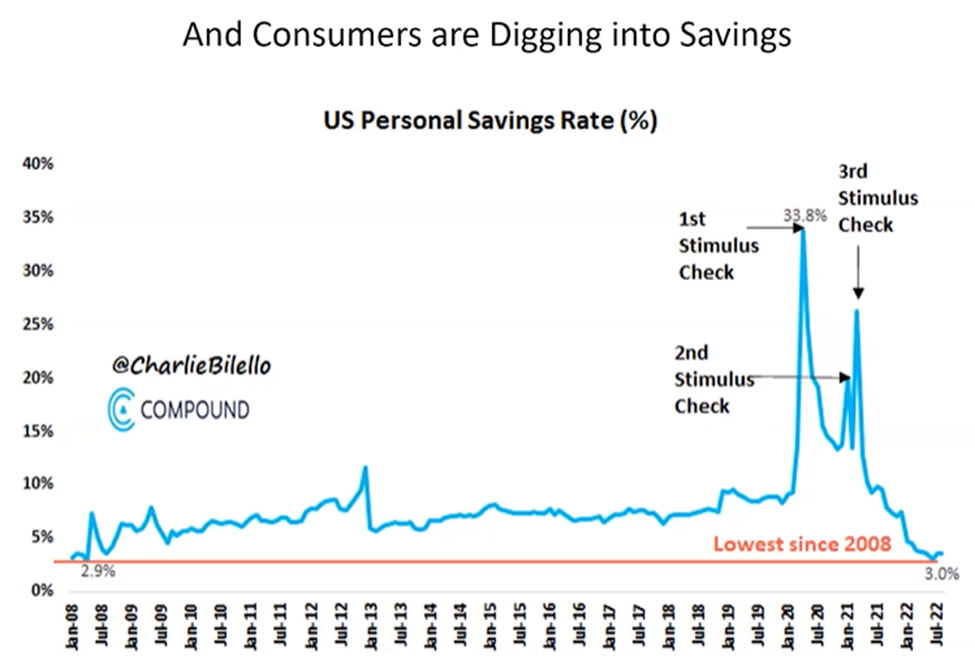

Another key component is savings. The savings rate has dropped to 3%, which is the lowest level since the 2008-2009 recession.

Savings are being depleted as consumers continue to spend. Also notice the pecks on this chart are the 1st, 2nd & 3rd stimulus checks that allowed them to get use to a level of spending/living.

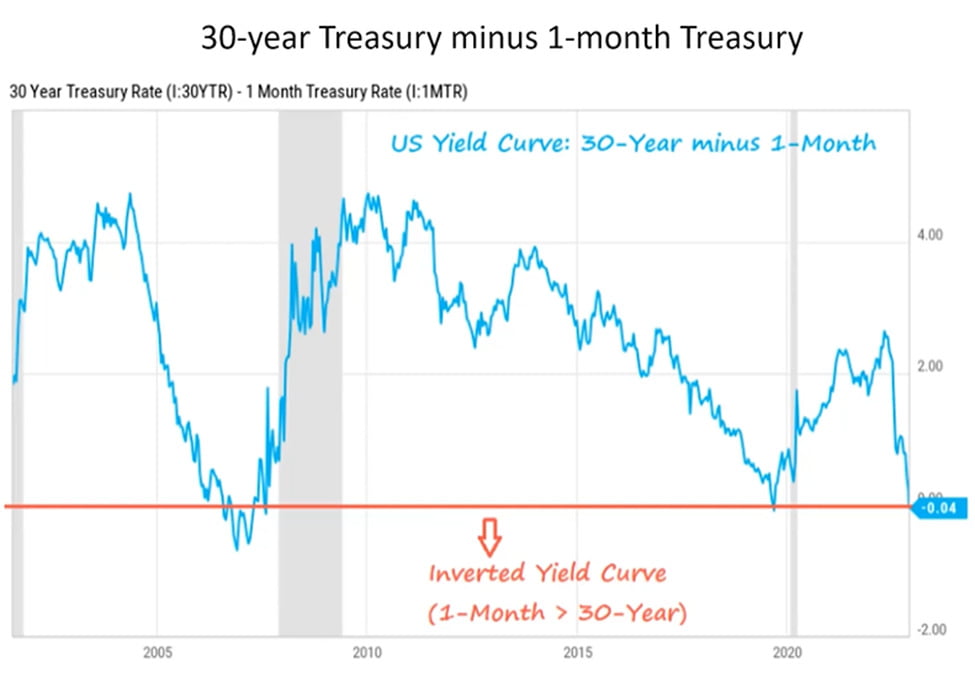

The final data point I want to bring to your attention is the 30 yr Treasury. Whether we have seen manufacturing slow, shipping is delayed, lay-offs within industries, a key indication is the Treasury yield curve. If you invest your money longer, you should see a greater return. 1yr investment does not return what a 5yr, 10yr or 30yr would return. We see below an inverted yield curve on the 30yr.

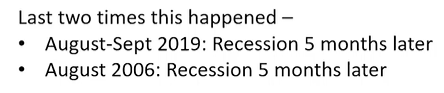

We are seeing short term investments making more than long-term investments, or inverted Yield curve. We have seen a recession after the last two times this has taken place.

Why is this all important to me Blair? What is the point? This is important to you since anytime a recession has come, we see inflation drop and we all know that inflation is a direct impact on Mortgage Rates. If we are not already in a recession, we will be shortly and as inflation drops, so does MBS rate (Mortgage-Backed Securities). This means that the first QTR of 2023, we should see rates dropping into the mid to low 5s. Activity for all of us should pick up.

A key issue on the very near future, SMART-TD, one of the nation’s largest rail unions voted to reject their labor deal. BLET, another large rail union, voted to ratify the deal, but said it would strike with any other unions that voted against it. If there is no agreement met, the strike date is currently set for Dec 5th. If this date is kept then strike prep would begin on Nov 28th, which is the day the Senate comes back from thanksgiving break. A strike like this would have an estimated negative impact of $2Bill per day and would not do any favors for inflation.

I’m Blair Thomas and I am here answer any questions.

Since leaving the US Army in 1990, Blair has been serving and helping people. With an extensive customer service background along with integrity, strong work ethic and a personal desire to see others succeed in their dreams, Blair helps you to succeed in buying a home.

We try to bring Real Estate, Lending & learning together.