Week of August 22, 2022 in Review

Fed Chair Jerome Powell gave an important speech at the annual Jackson Hole Economic Symposium, while two July housing reports showed a slowdown in signed contracts for new and existing homes. Here are the key stories:

- Fed Chair Powell Vows to Continue Inflation Fight

- Pending Home Sales Tick Lower in July

- July’s New Home Sales Fizzle

- What’s Ahead for Jobless Claims?

- Second Quarter GDP Remains Negative

Fed Chair Powell Vows to Continue Inflation Fight

The Fed’s favorite measure of inflation, Personal Consumption Expenditures (PCE), showed that inflation fell 0.1% in July, which was in line with expectations. The year over year reading declined from 6.8% to 6.3%. Core PCE, which strips out volatile food and energy prices, rose by 0.1% with the year over year change declining from 4.8% to 4.6%.

What’s the bottom line? During his speech last week at Jackson Hole, Fed Chair Jerome Powell confirmed that the Fed would continue “using our tools forcefully” to attack inflation, which remains near 40-year highs and well above their target range.

To help cool inflation, the Fed has been hiking its benchmark Fed Funds Rate, which is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. So far this year, we have seen 25, 50, 75 and 75 basis point hikes at the Fed’s March, May, June and July meetings, respectively. Counterintuitively, Fed rate hikes can be good for mortgage rates if they’re perceived to curb inflation.

The Fed will be closely watching upcoming economic reports ahead of its meeting on September 20-21, as these will play an important role in their decision regarding the size of their next rate hike.

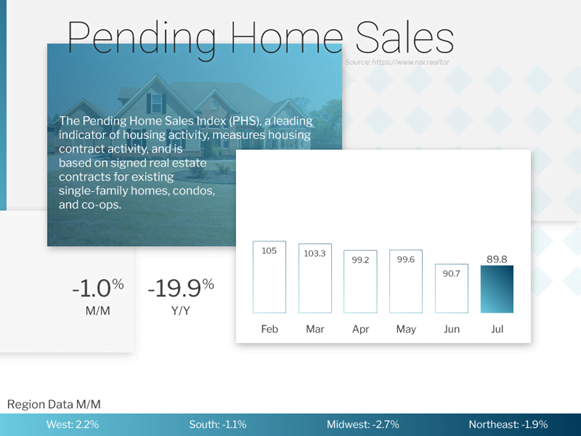

Pending Home Sales Tick Lower in July

Pending Home Sales fell 1% from June to July, though this was better than the 3% drop that was expected. Sales were also nearly 20% lower than they were in July of last year. This is a critical report for taking the pulse of the housing market, as it measures signed contracts on existing homes, which represent around 90% of the market.

Given the time it can take to find the right home, July’s data likely reflects buyers who were house hunting in June before finding a home and signing a contract in July. Mid-June is when rates peaked earlier this year, which is why a larger decline in signed contracts was expected in July’s report.

What’s the bottom line? Lawrence Yun, chief economist for the National Association of Realtors, said he believes we “may be at or close to the bottom in contract signings,” noting that July’s modest decline reflects the “recent retreat in mortgage rates.” He added that, “Home prices are still rising by double-digit percentages year-over-year, but annual price appreciation should moderate to the typical rate of 5% by the end of this year and into 2023.”

Lower appreciation is very different from home price declines and is still very beneficial for wealth creation. For example, if someone bought a $400,000 home and put 10% down, 5% appreciation means they would gain $20,000 in appreciation over the next year and earn a 50% return on their investment due to leverage.

July’s New Home Sales Fizzle

New Home Sales, which measure signed contracts on new homes, declined 12.6% from June to July to a 511,000-unit annualized pace, coming in much worse than expected. Sales were also nearly 30% lower than July of last year. The median price for new homes was $439,400 but remember, this is not the same as appreciation. It simply means half the homes sold were above that price and half were below it.

What’s the bottom line? There is no doubt that higher interest rates have impacted demand for homes, but low inventory continues to be a factor as well. Remember, a 6 months’ supply of homes is considered representative of a balanced market. And while there were 464,000 new homes available for sale at the end of July, which equates to a 10.9 months’ supply, there’s more to this data than meets the eye.

Only 45,000 or less than 10% of the available homes were actually completed, while 23% had not even been started and 67% were still under construction. When factoring in the amount of completed homes, the month’s supply of new homes available was closer to one month, well below what’s considered balanced. On a related note, data released earlier this month from the National Association of Realtors showed that the amount of existing homes at the end of July was also below a balanced level, with just a 3.3 months’ supply available.

While we are clearly seeing an activity recession in housing, low inventory should continue to be supportive of home prices.

Since leaving the US Army in 1990, Blair has been serving and helping people. With an extensive customer service background along with integrity, strong work ethic and a personal desire to see others succeed in their dreams, Blair helps you to succeed in buying a home.

We try to bring Real Estate, Lending & learning together.